T: 01822 851370 E: [email protected]

Rural Communities Demand An Equal Footing in Government Funding

As the final Local Government Finance Settlement looms, the Rural Services Network (RSN) is pressing for a fair distribution of government funding that recognises the unique challenges faced by all communities, particularly those in rural areas. This advocacy highlights the unique challenges faced by rural communities, who are central to the nation’s fabric but not receiving a proportionate share of government resources.

As the final Local Government Finance Settlement looms, the Rural Services Network (RSN) is pressing for a fair distribution of government funding that recognises the unique challenges faced by all communities, particularly those in rural areas. This advocacy highlights the unique challenges faced by rural communities, who are central to the nation’s fabric but not receiving a proportionate share of government resources.

Documented Disparities in Government Funding

The stark disparities between rural and urban communities are documented in a detailed House of Commons Research Briefing on the Local Government Finance Settlement for 2025/26, prepared by Philip Brien and Mark Sandford, published on 30 January 2025. This briefing reveals that rural residents endure significantly higher council tax burdens compared to their urban counterparts and receive less government-funded spending power. The report states: "Core spending power across England as a whole will see a nominal increase, but this masks the ongoing challenges for rural areas" (pg. 15-17).

The Burden of Council Tax on Rural Households

The briefing explains the composition of core spending power, which is crucial for understanding the financial pressures on rural taxpayers. In 2025/26, the estimated total core spending power across England is £68.9 billion—an increase of 6.0% in cash terms. Notably, over half of this amount, £38.3 billion (55.6%), is expected to be raised through council tax. This indicates that if local authorities need to leverage additional revenue, it is the residents who will ultimately bear the cost through higher taxes. This reliance on council tax exacerbates the financial strain on rural households, who already face higher rates with fewer services in return.

Inadequate Funding Mechanisms

The same briefing highlights the challenges of uneven funding distribution, particularly noting how adjustments in grants have impacted various regions differently: "The Recovery Grant was designed to have a different distribution to the previous grants, with a specific emphasis on funding areas with higher levels of deprivation and lower ability to raise money via council tax. In practice, the net effect of this change was generally positive for metropolitan districts, and broadly neutral for all other classes of authority." (Page 18). This analysis shows the need for reform to ensure that rural communities, which often face unique financial challenges, do not continue to lag due to systemic funding disparities.

Graphical Highlight of Funding Disparities

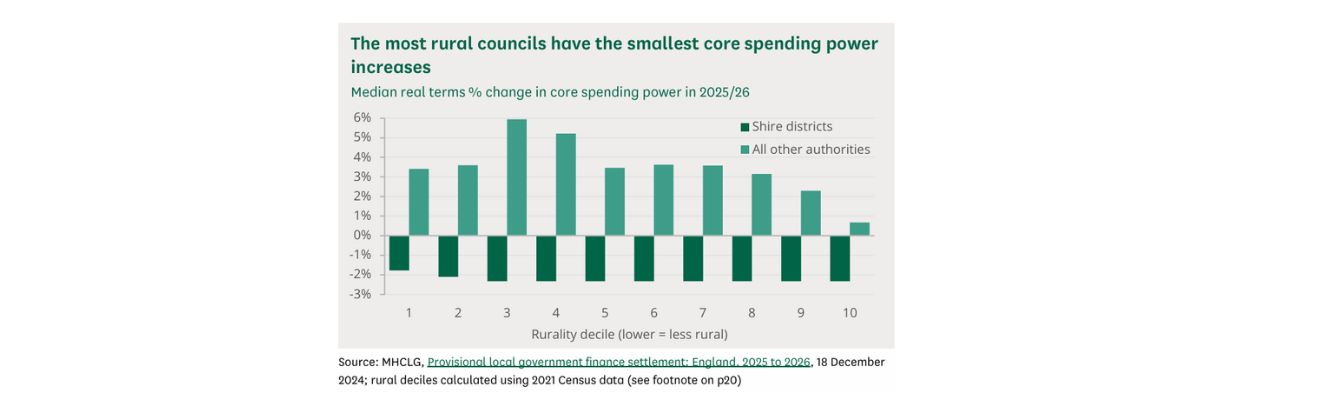

A telling graph on page 21 of the briefing illustrates the minimal growth in funding for the most rural councils compared to their urban counterparts, highlighting the smallest increases in core spending power for rural local authorities. This powerfully illustrates the disparities, showing that rural areas are not receiving the necessary support to maintain and improve essential services.

A telling graph on page 21 of the briefing illustrates the minimal growth in funding for the most rural councils compared to their urban counterparts, highlighting the smallest increases in core spending power for rural local authorities. This powerfully illustrates the disparities, showing that rural areas are not receiving the necessary support to maintain and improve essential services.

Upcoming Motion in the House of Commons

This critical issue will be spotlighted during a forthcoming motion on the Local Government Finance Report in the House of Commons on 5 February 2025. This presents a pivotal opportunity to address these documented inequalities and push for reforms that ensure a fairer distribution of resources.

Kerry Booth, Chief Executive, Rural Services Network:

As we prepare our response to the second consultation on local funding reform, it is crucial that we seize this opportunity to collectively address the deep-seated inequities in our funding system. The disparities we've discussed are not just numbers; they are realities that affect the sustainability of our rural communities every day. I urge all stakeholders to join us in this critical dialogue before the consultation closes on 12 February. Your insights are essential in shaping a future where rural areas receive the fair funding they rightfully deserve.

SIGN UP TO OUR NEWSLETTER

Sign up to our newsletter to receive all the latest news and updates.